CMA CGM

Better Ways

Second-quarter 2023 financial results

- Further normalization of the transport and logistics markets.

- Revenue and operating profit down, in line with first-quarter guidance.

- Stable contribution of the logistics segment supported by external growth and the dynamism of certain activities.

- Financial strength supporting continued investments and the implementation of the Group’s decarbonization strategy.

The Board of Directors of the CMA CGM Group, a global player in sea, land, air and logistics solutions, met today under the chairmanship of Rodolphe Saadé, Chairman and Chief Executive Officer, to review the financial statements for the second quarter of 2023.

Commenting on the results for the period, Rodolphe Saadé, Chairman and Chief Executive Officer of the CMA CGM Group, said:

“As expected, our industry continued to normalize in the second quarter and, despite difficult market conditions, our performance remains robust. In recent years, we have significantly strengthened our two strategic pillars: transport and logistics. On that basis, our Group will pursue its transformation, as it continues to expand and to integrate recently acquired subsidiaries, while stepping up investments to decarbonize its activities”.

Second-quarter 2023 operating and financial performance

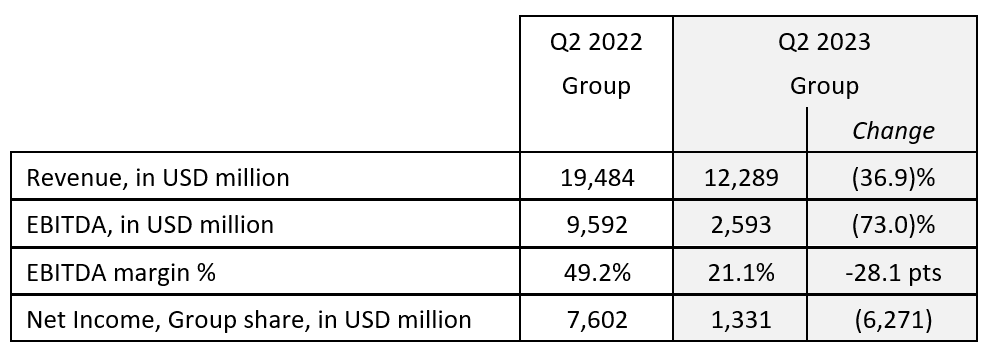

Group: lower performance reflecting difficult market conditions

First-quarter 2023 trends remained at play in the second quarter of 2023, with deteriorated market conditions in the transport and logistics industry.

Despite a rebound in demand for transport in the second quarter of 2023 compared with the previous quarter, driven by a degree of macroeconomic resilience and lower energy prices, the transport and logistics market remains depressed.

Revenue stood at USD 12.3 billion in the second quarter of 2023, driven mostly by the Group’s shipping business. EBITDA came to USD 2.6 billion, 73% lower than in second-quarter 2022. EBITDA margin came in at 21.1%, down 28.1 points. Net income, Group share amounted to USD 1.3 billion. Financial resources net of debt totaled USD 3.8 billion at June 30, 2023, down USD 1,852 million from December 31, 2022.

The Group continues to invest in supporting the energy transition for transport and logistics:

- by maintaining its assertive investments to diversify the energy mix with the aim of achieving Net Zero Carbon by 2050, with over USD 14 billion invested in a fleet representing more than 100 LNG- and methanol-powered ships;

- by creating CMA CGM's Fund for Energies with a budget of €1.5 billion over five years. Outlays of €430 million have already been committed to accelerate the energy transition across the Group’s worldwide sea, land, air and logistics activities.

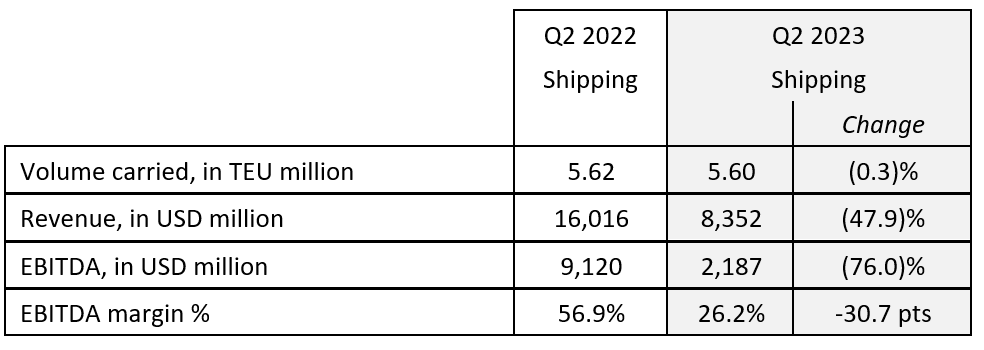

Shipping

Consolidated revenue from shipping operations amounted to USD 8.4 billion, down 47.9% from second-quarter 2022. EBITDA totaled USD 2.2 billion, 76% lower than in the prior-year period. EBITDA margin came in at 26.2%, down 30.7 points. Average revenue per TEU amounted to USD 1,491, down 10.3%

year on year.

Volumes remained buoyant on the North-South lines, but the Transpacific and Asia-Europe lines were hit by the slowdown in household consumption and dealer inventory drawdowns.

In second-quarter 2023, the Group carried 5.60 million TEUs, down 0.3% on the second quarter of 2022 despite an 11.5% rebound compared with the first quarter of the year, reflecting the seasonal nature of the business but also an upturn in demand.

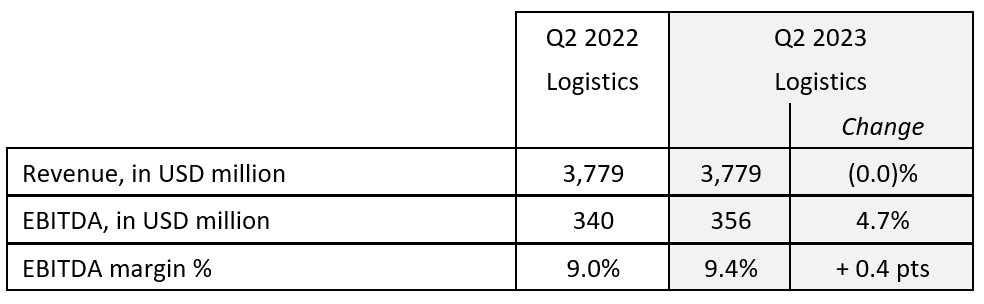

Logistics

Revenue from logistics operations totaled USD 3.8 billion in the second quarter of the year. EBITDA stood at USD 356 million, a 4.7% increase on second-quarter 2022.

The stability of the logistics business, in a context of declining trade, reflects both the slowdown in freight markets and the strengthening of the end-to-end supply chain services offered to CMA CGM Group customers through the acquisitions made since second-quarter 2022 of Ingram CLS, Gefco and Colis Privé.

Freight management activities are impacted by the declining market. Contract logistics activities are recovering in Europe but remain generally affected by the weakness of the e-commerce segment, particularly in the United States. Finished Vehicle Logistics are performing well supported by favourable market dynamics due to the combination of persistent supply chain disruptions and strong demand.

During the second-quarter 2023 the CMA CGM Group submitted an offer to acquire Bolloré Group's freight forwarding and logistics operations, which will strengthen CMA CGM's logistics expertise in a wide range of high value-added sectors. CMA CGM's logistics operations are set to rank among the world's top five players in transport and logistics.

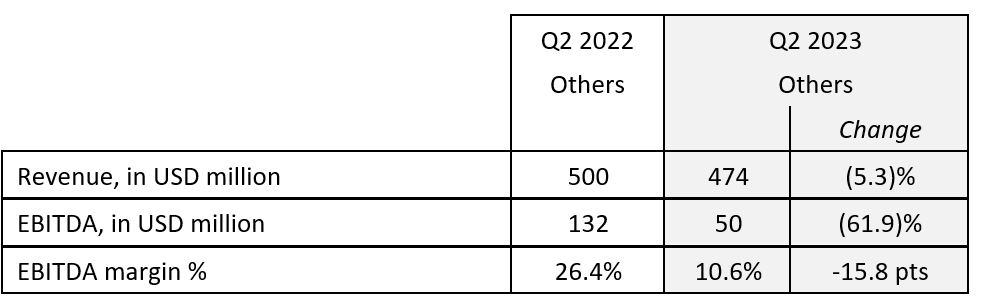

Other activities

Revenue from other activities, which include port terminals and CMA CGM Air Cargo, fell to USD 474 million. EBITDA was USD 50 million, down 61.9%, mainly due to lower volumes in port terminals and a less buoyant air transport market.

Outlook

Macroeconomic and geopolitical uncertainties and deteriorating transport markets

Late 2022 trends continued to prevail in the first half of 2023, with deteriorated market conditions in the transport and logistics industry. Macroeconomic forecasts for the second half of 2023 anticipate sluggish global growth given the persistent inflationary pressures weighing on consumer spending as well as the measures taken by central banks in response, and geopolitical uncertainties. In light of uncertain demand, new capacity arriving on the market is likely to weigh on freight rates in shipping, particularly on East-West lines.

The Group's financial results continue to return to normal as indicated in the previous quarter. The Group is confident in its ability to weather the cycle thanks to its combined transport and logistics strategy and its financial strength. Given the inflationary environment, we are being particularly vigilant about keeping operating costs under control.